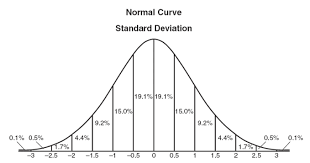

Remember the bell curve? It’s a figure of speech at this point, but the last time you probably saw one on paper was in high school. You can graph virtually any observable thing and with enough data points you’ll likely find a naturally occurring bell curve. The height of DEUCE Gym members, the average time duration of workouts at DEUCE Gym over the course of a year, or any other silly observation will work. The bell curve begins to chart the majority of our common experiences in the belly of the curve. Near the median, there are numerous like experiences which give this portion of the graph its height. As you move into the tails, there are less and less instances of the data in question. For example, when looking at the data of workout times last year there are a ton of 6-15 minute long training efforts (the belly of the bell curve) and just that one stupid forty minute long one and the one ninety second long workout (the tails of the bell curve).

The problem with this bell curve is that it takes up too much of our perspective. I’d argue we incorrectly view risk and probability through the lens that too often forces very round experiences into a bell curve-shaped  hole. While the bell curve is a household name for good reason, the error is in the fact that we don’t understand the tails very well. Hell, in grade school science class we’d call data that fell too far outside of the bell curve a bad name (“outliers”). Many course lessons allows students to remove “outliers” from the data set in an effort to protect calculations like average or “mean”. If, for example, you wanted to do some basic behavior analysis of the local grade school fundraising effort and your data set of sixty-four classmates sold between $45 and $130 dollars worth of magazine subscriptions, that’s one thing. Things get weird, though, when there’s that one kid with the gnarly, Type-A, CFO mom who took to her entire multinational corporation to raise $3200 in magazine sales that no one wants. Now, what do we do? Growing up, we were usually taught to just pretend it didn’t happen. You throw out the “outlier”. After all, it’s much more helpful to say the average amount raised was $71.50 than include the outlier and make some crazy claim like the average student fundraising effort is $1250 when only one other kid raised more than a hundred and thirty bucks. The problem with throwing these pieces of data out is they are real. As much as these “fat tails” are problematic to tidy mathematics, life doesn’t give a damn about tidy anything.

hole. While the bell curve is a household name for good reason, the error is in the fact that we don’t understand the tails very well. Hell, in grade school science class we’d call data that fell too far outside of the bell curve a bad name (“outliers”). Many course lessons allows students to remove “outliers” from the data set in an effort to protect calculations like average or “mean”. If, for example, you wanted to do some basic behavior analysis of the local grade school fundraising effort and your data set of sixty-four classmates sold between $45 and $130 dollars worth of magazine subscriptions, that’s one thing. Things get weird, though, when there’s that one kid with the gnarly, Type-A, CFO mom who took to her entire multinational corporation to raise $3200 in magazine sales that no one wants. Now, what do we do? Growing up, we were usually taught to just pretend it didn’t happen. You throw out the “outlier”. After all, it’s much more helpful to say the average amount raised was $71.50 than include the outlier and make some crazy claim like the average student fundraising effort is $1250 when only one other kid raised more than a hundred and thirty bucks. The problem with throwing these pieces of data out is they are real. As much as these “fat tails” are problematic to tidy mathematics, life doesn’t give a damn about tidy anything.

We assume, incorrectly that the tails are relatively connected to the median by a understandable standard deviation. That’s how it looks on the graph, anyway. Yet, life continues to demonstrate unknown and unknowable outliers with standards of deviation that are off the charts.

When it comes to our life experiences and our understanding of things like risk and probability, it’s the tails that should garner more of our attention. The tails are both where the biggest upside is and where the biggest danger is. For example, most investments return less than 10%, while some return 3000%. Also, most people have auto insurance, but very few have economic collapse insurance.

Take a normal day. A normal day goes smack dab in the middle of the bell curve. Now take the days that have had the most impact on your life. Maybe these examples come in the form of a decision to quit smoking or a choice to start a new project. These life experiences barely even register on the graph because of how infrequent they are, but have exponential weight attributed to them, nonetheless. Yet, we cultivate our lives around the bell curve. Everyone knows what their plan is for laundry day, but a minuscule amount have thought about how they can put themselves in position to 12x their net worth, for example.

Conversely, we’re quite ready for the common daily troubles. The harsh reality is there are outlier events coming our way that won’t have the tidy reference point a few standard deviations away from the median of our “normal” day. We’re relatively ready for arriving to our destination and find that it’s difficult to find parking. Yet, we’re largely unprepared for the next instance of cyber warfare to eliminate our life savings. Our faulty perspective that doesn’t account for the unimaginable leaves us exposed. Chew on this. Losing your job, breaking your wrist, and riding out the next 5.5 earthquake are all bell curve-type events. In the context of the bell curve of human experience, those are the easy ones!

While the bell curve helped us in the classroom as teenagers, this thinking will, at the very least, leave you in mundane misery. That is, of course, if it doesn’t kill you, or worse.

Like any important message, this isn’t just a dose of reality. There is an action step here believe it or not. The action step is to reframe your view of reality. Reality includes tails on our pretty little bell curve chart longer than you could ever draw on paper. The most amount of happiness in your life will come from events outside of the bell curve. The same is true for the opportunity for remarkable memories, laughter, and even money. The usual, bell curve days don’t make for remarkable memories in the same way the the usual jokes don’t get life changing laughs and basic career moves don’t pay fortunes. Similarly, the hardships of the greatest threat to you won’t be found in a list of usual suspects. Life rewards robust individuals and the more time you spend at the median, the most exposed you are to destruction. Your protection exists in your ability to walk out into the fringes of your comfort zone.

Logan Gelbrich

@functionalcoach

5/17/17 WOD

Complete the following for time of:

45 Pull Ups

15 Hang Cleans (135/95)

800m Run

15 Hang Cleans

45 KB Swings (70/53)